Koru Capital

Advices from Business Owners, for Business Owners

ADVISORY

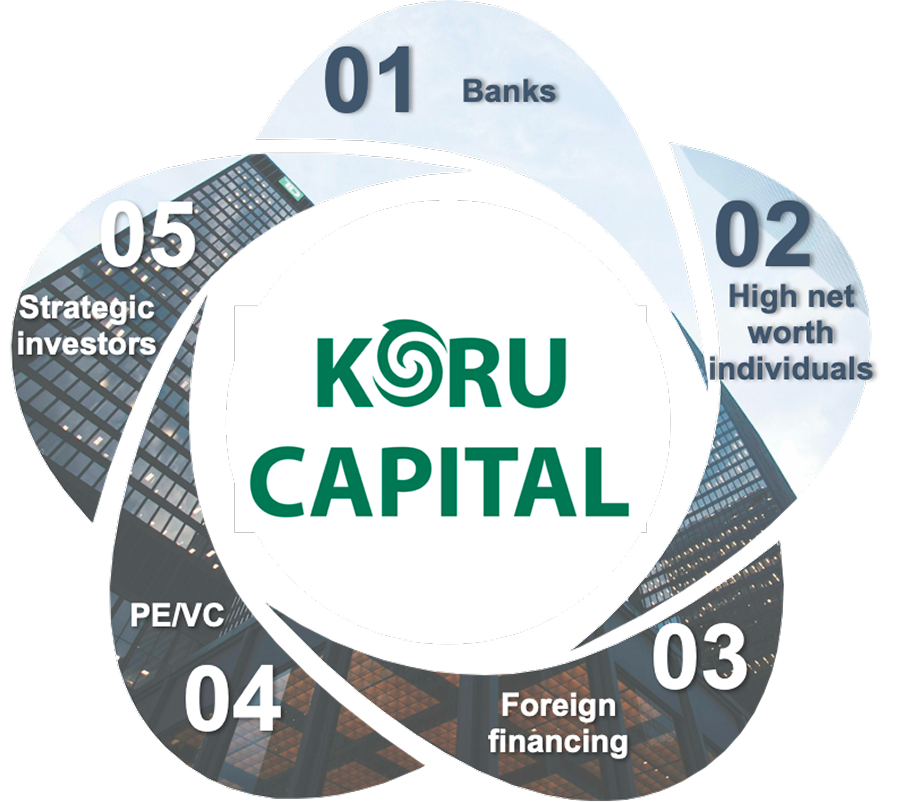

300+ Investors/Banks

With Direct Connection To Decision-Maker

Each fundraising profile is thoroughly evaluated by Koru Capital to identify the most suitable funding sources and maximize value for the business owner

- Qualified financial reports

- Having collateral assets

- Looking to optimize capital costs

- Businesses not meeting banks’ financial reporting requirements

- No collateral assets

- Need flexible terms and fast disbursement

- Businesses seeking capital partners and long-term strategic collaboration

Optimizing the company’s

existing bank loans

Connecting with

non-bank funding sources

Connecting with

foreign financing sources

Connecting with investment

funds and strategic investors

OUR PRODUCT

M&A and Capital raising

We advise on buy-side and sell-side M&A transactions, as well as equity fundraising for mid- to large-scale deals. Our support covers deal structuring, investor outreach, negotiation, and end-to-end execution.

Debt advisory and restructuring

We help clients design and execute optimal debt solutions—including new financing, refinancing, and restructuring—aligned with business needs and lender requirements.

Commercial Due Diligence

We provide strategic commercial due diligence services to support investment decisions, fundraising, or internal planning, with a focus on market positioning, growth potential, and financial performance.

RECENT TRANSACTION

10

Completed

Transactions

in 2024 & 2025

30%

Success Rate

in 2024

$200

Million USD

fundraised

by 2025

Sep 2023

Advised the

fundraising round of

![]()

Nov 2023

Advised the fundraising

round of Hasaki from Alibaba

![]()

Jan 2024

Advised the fundraising round of

the leading media group in Vietnam

![]()

Jan 2024

Advised the fundraising round of

TKT Packaging

![]()